10 Smart Investment Strategies to Build Wealth Over Time

An effective strategies for increasing money and securing your financial future is investing.

Whether you’re just starting out or have years of experience, having a strategic approach is crucial to ensure consistent returns on your investments.

This post will look at ten wise investment tactics that can make you wealthy in the long run.

1. Diversify your investment Strategies

Diversification is one of the fundamental principles of investing.

You can lower your risk exposure by distributing your investments among a variety of asset types, including stocks, bonds, real estate, and commodities.

Diversification enables you to take advantage of gains in other areas while reducing the impact of any potential losses in one particular investment.

Don’t forget the proverb, “Don’t put all your eggs in one basket.”

2. Put money into index funds

A common investing choice for long-term wealth building is index funds.

These funds follow a particular stock market index, like the S&P 500.

You can expose yourself to a wide range of businesses and industries by investing in index funds, which over time will produce relatively low-risk and consistent returns.

Additionally, actively managed funds typically charge higher fees than index funds, which might reduce your overall returns.

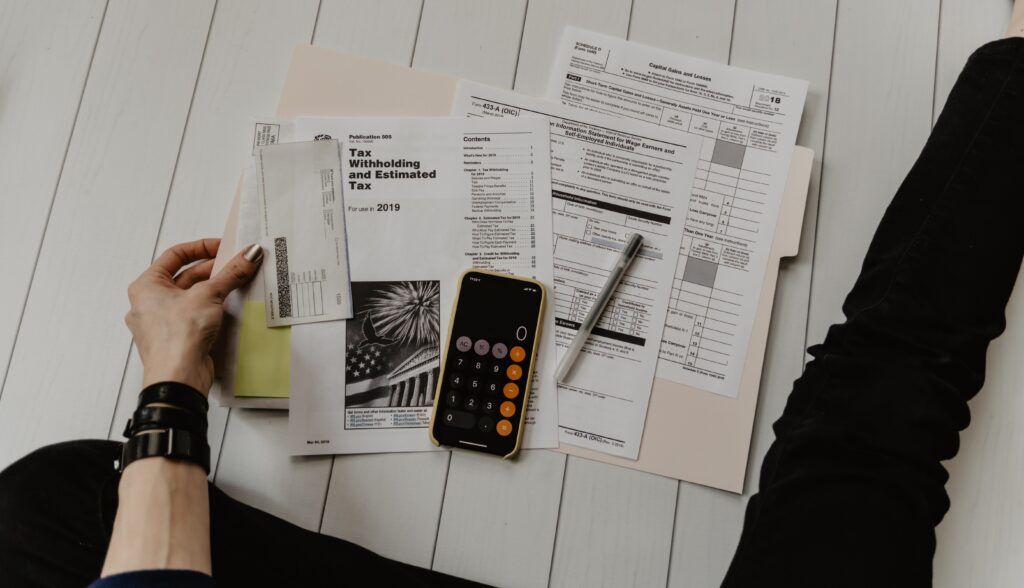

3. Benefit from tax-sheltered accounts

A wise approach for building long-term wealth is to make the most of tax-advantaged funds like 401(k)s or Individual Retirement funds (IRAs).

The growth of your investments is tax-deferred until withdrawal, and contributions to these accounts are frequently deductible from your taxes.

Utilizing these accounts will maximize your tax deductions while allowing your investments to increase rapidly over time.

4. Adopt a long-term viewpoint

Investment demands patience and discipline; it is not a get-rich-quick program.

Do not attempt to time the market or act rashly based on momentary changes.

Instead, concentrate on your investments’ long-term potential.

The famous quote from Warren Buffett reads, “Our favorite holding period is forever.”

Be ready for market gyrations and maintain attention on your long-term investment objectives.

5. Review and rebalance your portfolio on a regular basis.

Because markets are dynamic, your investment plan also needs to be.

Review your portfolio frequently, and adjust it if necessary.

Rebalancing entails moving your investments around in order to maintain the right asset allocation in accordance with your risk appetite and investment objectives.

This method makes sure you stay on track to meet your long-term wealth objectives and prevents your portfolio from being overly concentrated on one asset class.

6. Keep emotion out of it

Investment decisions may suffer as a result of emotions.

Investors frequently make irrational decisions that can hurt their long-term wealth building out of fear and greed.

It’s critical to keep your financial approach and emotions separate.

Keep to your goal, have faith in your research, and refrain from acting rashly due to short-term market volatility.

7. Average cost per dollar

With dollar-cost averaging, you invest a certain sum of money at regular periods regardless of the state of the market.

When prices are low, you can use this strategy to buy more shares, and when prices are high, you can buy fewer shares.

This tactic eventually smooths out market swings and can lower the average cost per share.

8. Educate yourself and seek out expert counsel.

Investing can be challenging, especially with the wide range of available possibilities.

Spend some time learning about various investment vehicles and approaches.

Maintain market awareness by reading books, going to seminars, and attending trade shows. Additionally, think about speaking with a financial counselor who can offer you individualized advice based on your particular situation.

9. Spend money on yourself.

Even if it may not be a conventional financial plan, investing in oneself is essential for building wealth over the long term.

Learn new things, expand your knowledge, and work to get better all the time.

You may boost your earning potential and create more prospects for riches in the future by investing in your education.

10. Stay current and flexible

Your investment approach should adapt as the world of investing does.

Keep up with the latest technical developments, economic trends, and governmental changes.

Be willing to change your investment strategies to take advantage of new opportunities and reduce risks.

The odds of creating long-term wealth are higher for individuals who remain informed and adapt throughout their investing careers.

# Summary

These ten wise investment strategies offer a solid foundation for anyone trying to build long-term wealth, in conclusion.

Always diversify your portfolio, adopt a long-term outlook, and periodically examine and adjust your holdings.

Avoid investing emotionally and whenever possible, utilize tax-sheltered accounts.

To adjust to the ever-changing investment environment, educate yourself, make an investment in yourself, and keep informed.

You can increase your chances of long-term financial success by adhering to these tactics.

Click Please ! Related Posts by hyekihong 🙂

[Investing – 1] Start Stock Market Investing (Beginner’s Guide)

[Investing – 2] 10 Smart Investment Strategies for Long-Term Wealth

[Investing – 3] Investment Options: The Pros and Cons of Different Choices